I originally wanted to start this article by focusing on the pandemic. It’s the obvious place to start – many businesses are struggling now more than ever, and the Billhop team have created a product that solves an urgent need: how to get efficient, accessible financing to companies that need to optimise their cash flows. But to focus on COVID is to take away from the fantastic success Billhop enjoyed even before the world got tipped upside down, so let’s start there.

How we met the team and why the product stood out

When I first met Seb and his team they were finishing up a year in which they had tripled revenues (after having doubled every year since 2016), had launched a new corporate product delivering 500% growth, and had over €1.5bn Total Payment Value in the pipeline. By any measurement that’s a pretty extraordinary year. What really struck us though was that this success represented a tiny proportion of the whole opportunity. We are therefore really excited to lead Billhop’s Series A and to be partnering with Seb, Erik, Ingemar and the whole team.

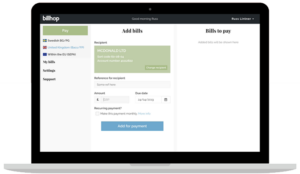

The Billhop product is focused and elegant. Very simply, their platform allows businesses to pay any invoice using their credit card even when the payee doesn’t accept cards, which is common due to network and processing fees. Customers can capture the interest-free period on cards as working capital financing and extend their cash balances without straining supplier relationships. For businesses where other, more complex financing options (think factoring) are not suitable or available, Billhop facilitates access to financing using a card product we are all familiar with. 50,000 customers, including a large number of Fortune 500 companies are already using Billhop.

This success represented a tiny proportion of the whole opportunity

The SME funding gap, and how Billhop is helping solve this problem

The SME funding gap is a well-documented problem. Even prior to the pandemic it was estimated SMEs in Europe lacked €400bn of bank financing and a total funding gap of €825bn. In the UK alone the gap was estimated at £77bn. This gap represents lost growth, lost investment, lost employment.

The problem is particularly acute in Europe where SMEs rely much more on bank financing than in other markets such as the US. Although there is a myriad of financing products available to SMEs many of these are complex, expensive and difficult to access. One study found it cost a UK bank £2,000 just to process an SME loan. Leveraging existing credit card programmes and rails provides SMEs with simple, efficient and, importantly, understandable access to financing. Add to the mix the advent of next generation card-based fintech businesses and Billhop’s facilitation of broader card acceptance is even more compelling. Frictionless financing at its best.

Billhop believes Corporate and SME payments in just the UK, France, Spain and Italy amount to c€7,000bn per year, and that c€4,800bn is currently “non card-able” spend.

Those gaps are Billhop’s opportunity.

Use your card to pay bills and invoices just like any other purchase.

Billhop’s current and potential customer base

The platform is not just for SMEs. It is increasingly being used by large, listed corporates for both working capital financing and tail-end spend. Billhop partners with global commercial banks to deliver bespoke card-based financing programmes, enabling corporate clients to utilise cards as a flexible and ready to use working capital financing solution with balance sheet benefits and no fixed or commitment fees. Customers also increase process efficiency by utilising their procurement cards for tail end supplier payments that are not card enabled. Adoption of this product has been phenomenal and for us here at Element Ventures [now 13books] really highlighted the size of Billhop’s addressable market – every corporate and SME in Europe has a need for their product.

How Billhop works with lenders

Let’s not forget the other side of the financing equation – the lenders. Banks and other card-based lenders benefit hugely from increased card acceptance and the wider use of card programmes as the channel for working capital financing. Billhop’s deep partnerships with a number of global banks are evidence of successful collaboration between a fintech and incumbents looking to reach a bigger market, and we believe continued replication of these partnerships is integral to Billhop’s long term success (if you’re a card-based lender reading this then get in touch and we’ll connect you!). Enabling greater card acceptance for lenders is especially important in a time when the nature and composition of that spend has changed so dramatically and lenders are looking for ways to diversify.

The data-centric approach that won our support

The need for Billhop’s product was evident in their data and progress prior to COVID but the last year has created a new urgency. Efficient and accessible financing options will be so important to European companies as they rebuild and recover from the impacts of COVID, and familiar tools like card programmes will be integral. Billhop is the technology that drives greater utility of these programmes – both for customer and lender.

We’re really proud to partner with the Billhop team. They have made amazing progress since we first met them and there is a ton of exciting news to come from them shortly. The opportunity is huge, the product is fantastic, and the need is urgent. The team is authentic, humble despite all their success, and a genuine pleasure to work with. And if you want to become a customer or partner, we’ll happily put you in touch!

Every corporate and SME in Europe has a need for their product