There’s an iconic moment in Back to the Future where Doc Brown and Marty are standing in a carpark, hair frazzled and shocked, having just sent a dog one minute into the future. Their faces perfectly express one thought, ‘did we really just do that?’. We saw that same expression when we met Christian, Hanna, Alex and the rest of the Hepster team last year. As the world changed so did their business – all of a sudden buying insurance online as part of an ecommerce journey was the default behaviour, and they were flying. (Look, I know insurance isn’t time travel but you get my point).

So today we’re announcing that Element Ventures [now 13books] is leading Hepster’s Series A and we’re thrilled to partner with them as they build Europe’s embedded insurance champion.

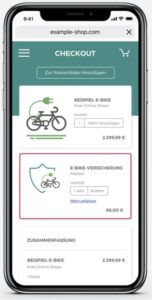

Hepster is changing the way we buy insurance. Their fully API-driven, modular MGA model provides tailored insurance products as part of an ecommerce journey. Utilizing a fully flexible construction kit they can create the necessary customization to embed insurance at the point of checkout – whatever you are buying. Their portfolio currently contains 275 insurance products, 100 of which were created in 2020 alone, each unique to a particular product and partner’s needs. By having flexible contract lengths, terms, and billing – all natively built for digital distribution – B2B partners can use the Hepster checkout integration to offer a seamless insurance purchase as part of any product journey. 60,000 customers and over 600 B2B partners now trust Hepster as their embedded insurance provider in Europe.

Even prior to COVID, the long-term trends in insurance were opening huge markets for Hepster. Incumbents are not architected, either in business model or technology, to sell insurance in the way consumers now demand. The inflexibility of their product creation and the ageing of the traditional channels means digital distribution, integrated into existing customer journeys, is simply too difficult. Thus, to modernise and innovate product distribution the incumbents must partner with digital MGAs such as Hepster. Take for example a recent Hepster board meeting where we discussed a new product entry brought to the team by a carrier simply saying, “we have a product, can you help us sell it?”. For insurers the partnership with Hepster reduces distribution costs, speeds up product innovation, and allows them to focus on their balance sheet and underwriting advantages.

For their B2B partners, Hepster provides a new tool for both monetisation and retention. Consider the specialty e-bike retailer. Having spent significant resources building a brand and community around their product, as well as a highly customised consumer offering, retailers don’t want customers jumping off their journey to buy insurance. By offering an integrated and tailored product the retailer can capture a portion of the insurance revenues and create stickiness in their customer relationship. All with one simple API integration.

Embed insurance at the point of checkout – whatever you are buying

But the big winners are consumers. Gone are the days of painful calls to get insurance quotes; filling in a million online forms only to find the product doesn’t really account for your needs; and comparison sites that squeeze every customer down the same journey. Hepster completely removes the friction of buying insurance and greatly expands the universe of insurable items. Modern consumers live in a world of ultra-customisation and it is time that our insurance experience was the same. Embedded insurance is a $3tn market globally (yes, that’s trillion) so the opportunity for Hepster is essentially limitless. Watch this space.

I know it’s becoming slightly trite to talk about the COVID impact in tech but it really would be remiss of me not to mention how the pandemic impacted Hepster’s business. It is exceedingly rare that two long-term, secular trends are accelerated and converged in such a way that a business’ trajectory is changed in such a short space of time. For Hepster, the changes in mobility and online shopping habits brought about by COVID transformed their market in a few short months. Suddenly, people were buying new means of mobility and they were buying them online…and they wanted everything insured. These changes are permanent, and structural shifts have been accelerated. Hepster added almost 500 B2B partners in 2020 alone and will soon be integrated at the checkout of some of Europe’s biggest online retailers. For Hepster COVID really did feel like 10 years in one.

Hespter will have completed their mission when everything bought online can be insured at checkout, seamlessly and with a completely customised product. Until then we’ll be partnering with them to help make it happen.

By offering an integrated and tailored product the retailer can capture a portion of the insurance revenues and create stickiness in their customer relationship.