Getting Started with Platform

As Head of Platform at 13books, my main responsibility is to support the growth of portfolio companies leveraging our platform.

Going back in time—my first exposure to the platform was in a slightly different context to the one I am in today. John Maynard Keynes’ once said, “It is easier to ship recipes than cakes and biscuits”— his quote was a foundation of the business model at the Opendesk office in 2015, establishing a direct connection (aka platform) between furniture designers, manufacturers and end-customers. Platform delivers value by connecting different players in the ecosystem.

Now, I must admit (although it may sound a tad cringey) that I am truly passionate about the value that platform can bring to the portfolio companies. But then again, I might be biased (😆).

The Challenge: Measuring Effectiveness

Back at Opendesk, we connected furniture designers with manufacturers and end-users. While on the surface this task may sound simple, the mechanisms to facilitate such connections are actually highly complex. Platform duties, in the context of VC, are no easier. In fact, my experience at 13books has proven more challenging than that at Opendesk due to both, the volume of possible connections and the low level of repeatability of connections due to their highly personalised nature.

Transactions across a VC platform are scattered by design, so there is a lack of obvious conversion metrics to prove how and when any given interaction turns out to be beneficial to either party. While many funds create their own platform metrics based on actions like email outreach, the real difficulty lies in tracking the effectiveness of those connections over time, and further adding or adjusting metrics as the funds focus evolves over time.

Jason Miller (Greycroft, BlackRock) in conversation with Shanna Hendriks (Tesla, New Enterprise Associate) and John Blaine (Tegus) at VC Platfrom Summit in New York.

It can take months, if not years to prove an ROI. But as Jason Miller, Founder & CEO of Foresight Data said at the VC Platform Global Summit ’23, “If you’re able to change the return of your portfolio by 0.5%, the actual return to your organisation can be significant 5-8 years down the line”.

“If you’re able to change the return of your portfolio by 0.5%, the actual return to your organisation can be significant 5-8 years down the line”

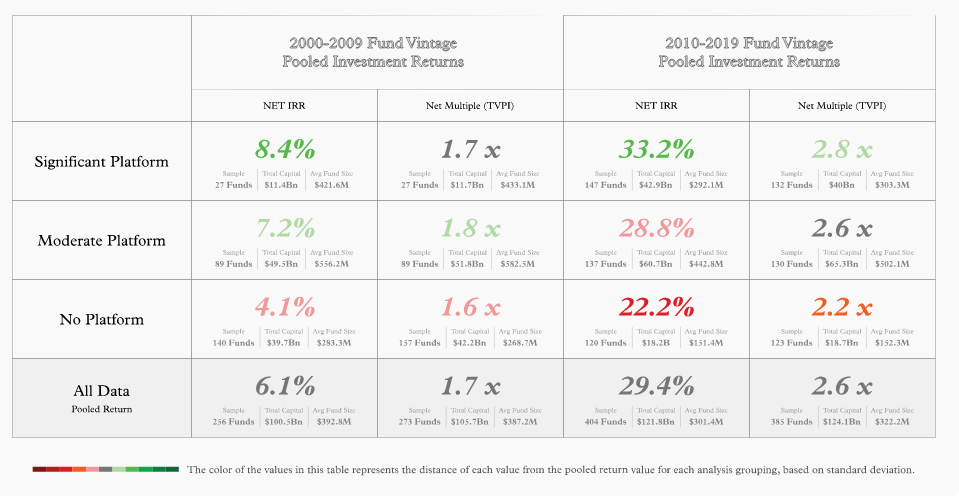

This was also echoed in a study, which analysed 850 venture capital (VC) firms’ team size, composition, and assets under management (AUM) from 2000 to 2022 to assess the impact of Platform roles on financial returns. Over two decades, Platform roles grew faster than the VC industry as a whole. Higher concentrations of Platform roles correlate with larger returns in both bullish and bearish market conditions. While VC firms aren’t required to invest in Platform roles, data suggests that increased Platform investment leads to stronger overall performance across the asset class. Funds with more significant investments in Platform teams generally boast higher Net IRR and TVPI compared to those without. The research was conducted by VC Platform Global Community, an organisation dedicated to advancing the Platform profession. You can find the link to download full report at the bottom of the page.

The investment in Platform teams correlates to better fund returns.

The investment in Platform teams correlates to better fund returns.

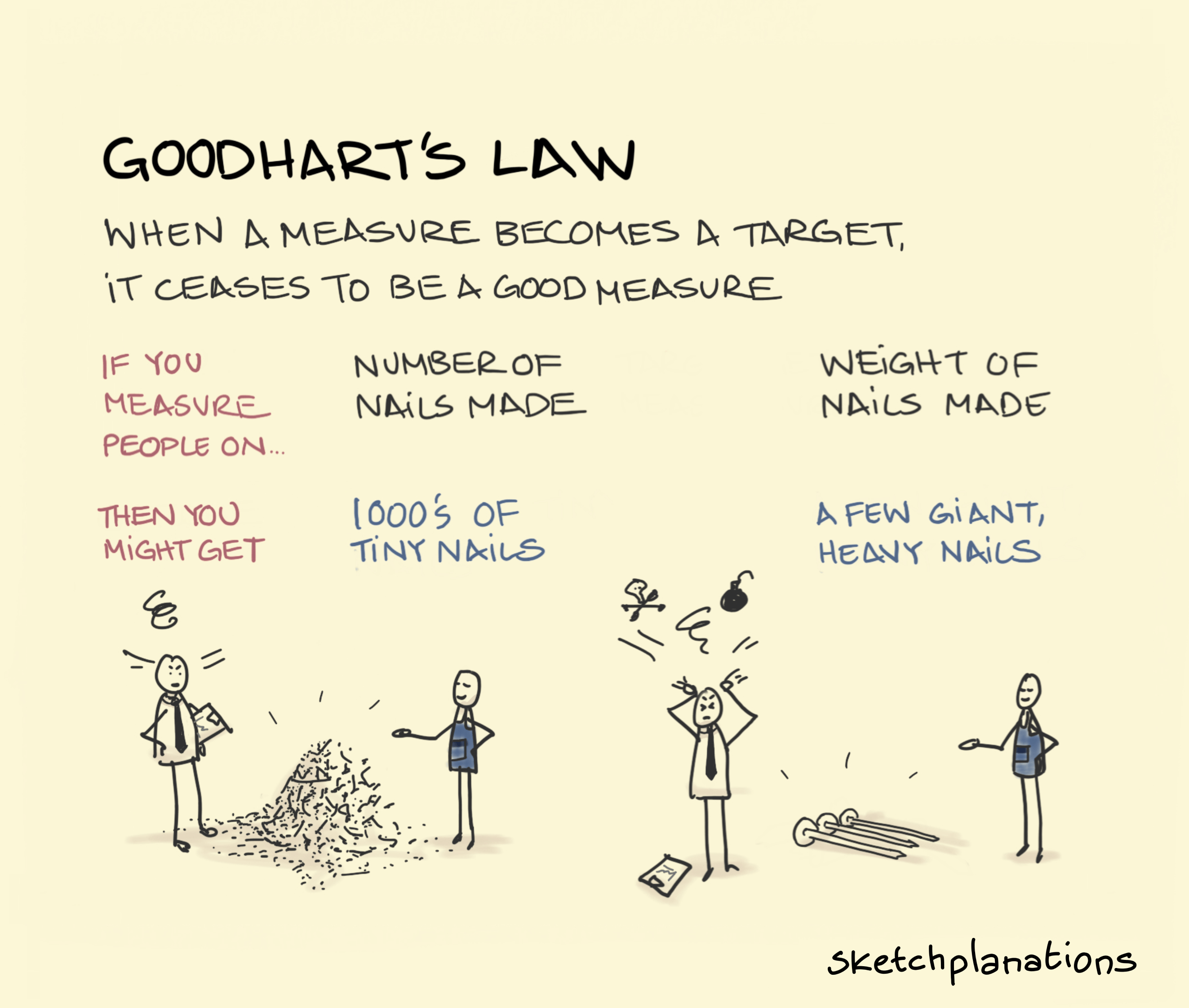

At the start of my journey at 13books, I feared the idea of setting up rigid metrics to measure platform success—Goodhart’s law, which says that “When a measure becomes a target, it ceases to be a good measure”, nagged at me. That’s why, instead of coming up with pure metrics to measure our success, I instead created proxy metrics. Doing so would help me prioritise and focus on the most impactful work at any given moment and then reflect and evaluate at each quarter-end. As an example, we are currently measuring how many steps it takes for us to make an introduction to a person or company when requested by a Founder. Doing this has given us a solid proxy metric to describe our true network coverage.

If you pick a measure to assess people’s performance, then they find a way to game it.

If you pick a measure to assess people’s performance, then they find a way to game it.

Once I’d considered the challenges ahead, the first step I took to set up a platform function at 13books was to…

Come back in two weeks’ time for the second part of this two-part series ‘How to set up a VC platform from scratch’. And don’t forget, if you’d like to find out more from Joanna in the meantime, contact her via LinkedIn and X. She’d love to hear from you!

In the meantime, a handful links you might be interested in reading that cover some of the topics discussed:

- The Power of Platform

- Goodhart Law

- Private equity operating groups and the pursuit of portfolio alpha